Tax Credit Scholarship

Give the Gift of Catholic Education

Do you wish to direct your Illinois State Tax dollars toward scholarships for children in need to attend private schools? You can even designate St. Mary of the Angels School as the preferred school for those scholarships.

For every $1,000 you donate to a scholarship granting organization (SGO) you are eligible for $750 tax credit (money you get back from the State of Illinois). If you designate St. Mary of the Angels School, then all of your $1,000 donated will go to support eligible students from families in need to pay their tuition bill.

Step 0: Calculate the maximum eligible donation.

0a. Go to your tax return from 2017 and see how much taxes you’ll likely pay for 2018 (alternatively, look at your pay stub and see how much taxes are being taken out from your pay check, then multiply by the number of pay checks you’ll receive in 2018).

For example: if you paid $3,000 in taxes in 2017, you’ll likely pay the same or more in 2018.

0b. Multiply your 2018 tax liability by 1.33.

Example (continued): if your 2018 tax liability is $3,000, then 1.33 x $3,000 = $4,000.

Alternatively: if you get paid every two weeks and $115.38 is taken out of your pay check for Illinois State Taxes, then $115.38 x 26 pay periods x 1.33 = $4,000.

0c. This is the amount you are eligible to take full benefit of the Invest in Our Children Act.

Example (continued): if you choose to donate $4,000 and designate St. Mary of the Angels School, all $4,000 dollars will come to our school and you will get a $3,000 tax credit (that is the amount taken off your tax bill, in other words, you’ll be refunded $3,000 when you file you Illinois State Tax Return).

STEP 1: You must request to activate an online account with the State of Illinois.

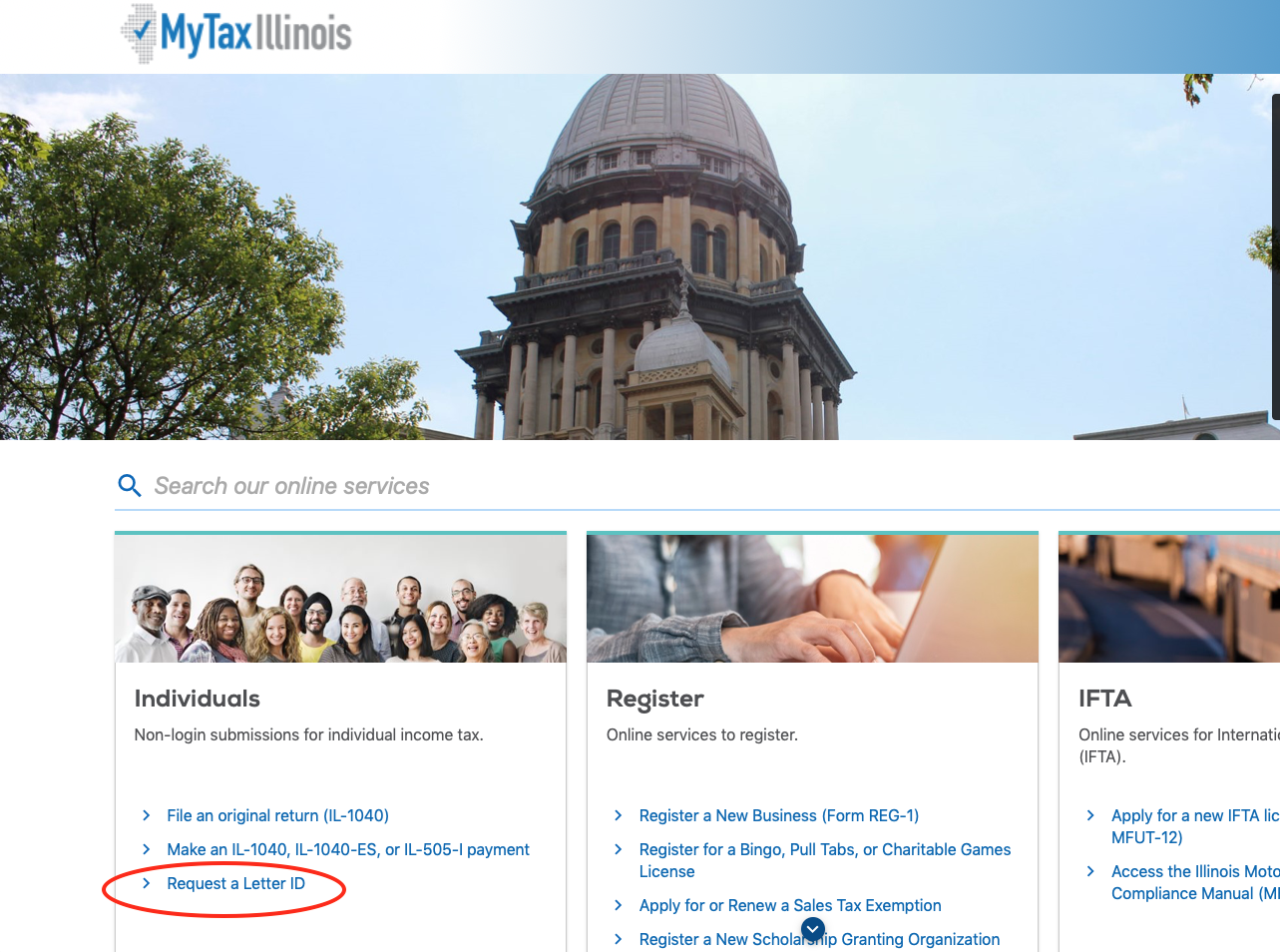

1a. Go to: MyTax.Illinois.gov

1b. Click on the “Request a Letter ID”

1c. Fill out the information to have a letter/email will be sent to you with a Letter ID needed to activate an account (This is their way of guaranteeing your privacy).

WAIT 5 to 10 days:

STEP 2: Activate your MyTax.Illinois.gov account.

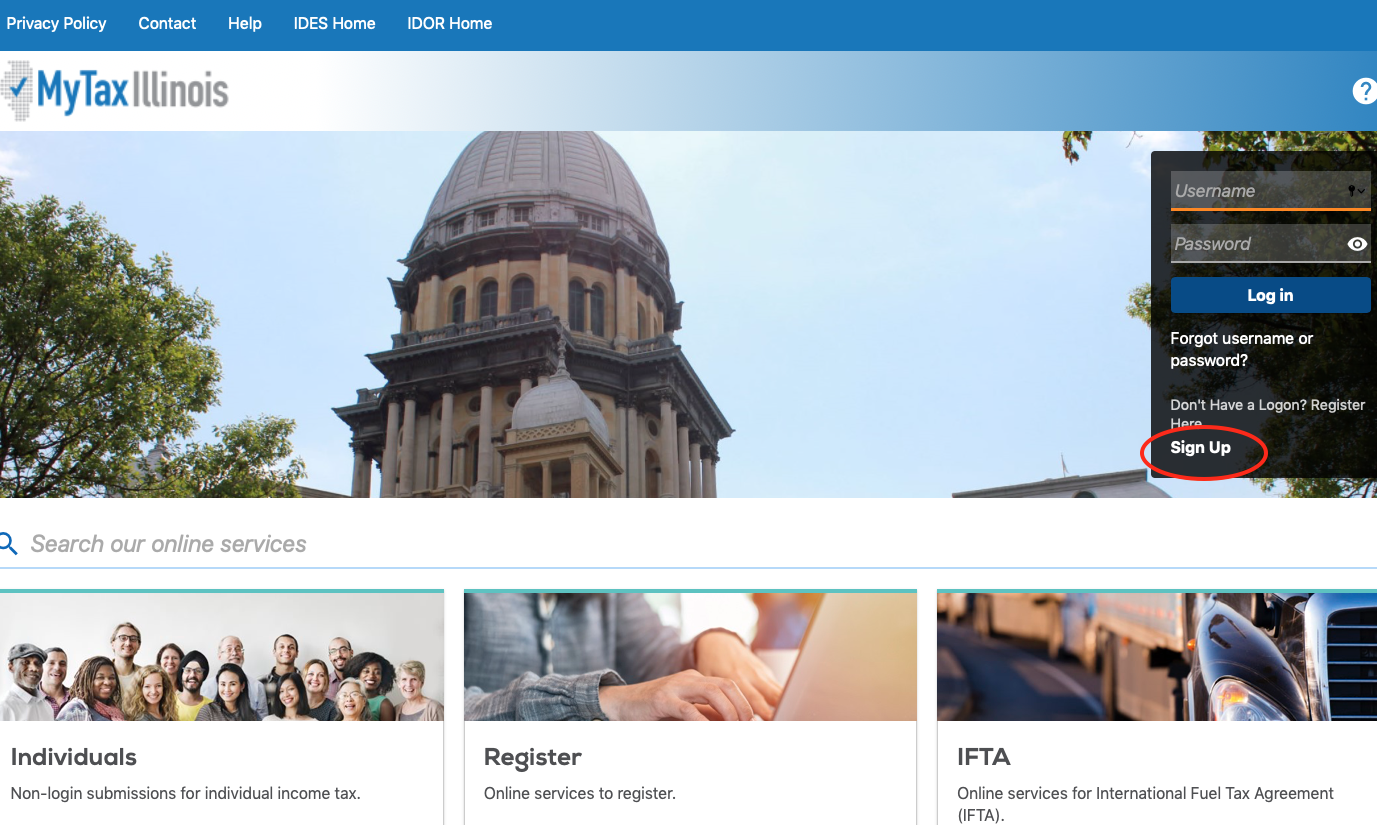

2a. Again go to: MyTax.Illinois.gov

2b. Click on the Sign up Now!

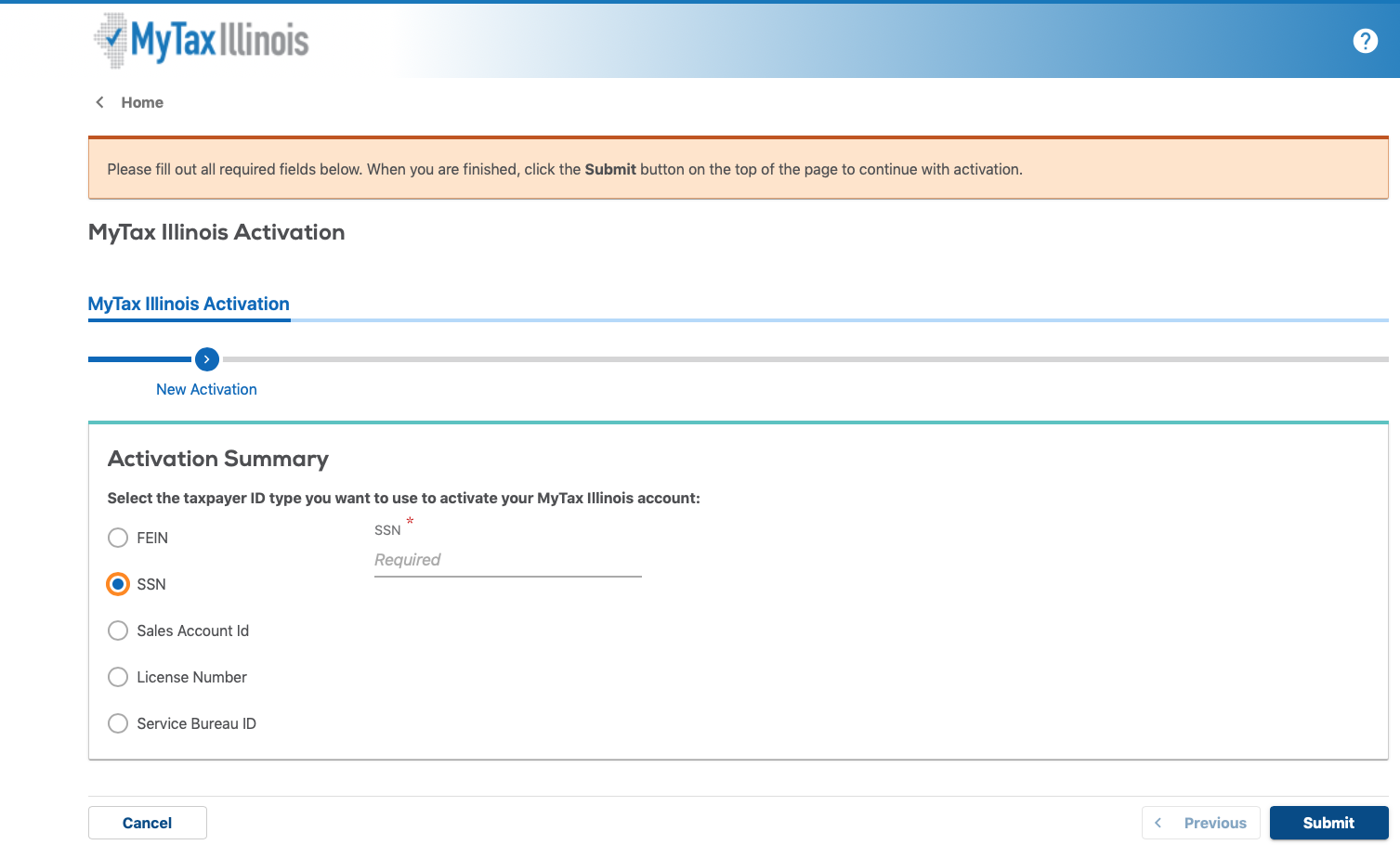

2d. It will then ask you for your Letter ID and another identification such as Prior Year Adjusted Gross Income. or your IL-PIN number (You can look that up by clicking on the Lookup my IL-PIN link).

2e. Put in your name, contact phone, and email; select a username and password, as well as security question and answer; confirm your email and password.

2f. Click submit at the top of the screen and you should be in!

Step 3: Reserving Your Tax Credit

Now that you have your MyTax.Illinois.gov account, with your own username and password, we may reserve your tax credit.

3a. Login to your account at MyTax.Illinois.gov

3b. After accessing the correct account, select “Contribute to Invest in Kids.”

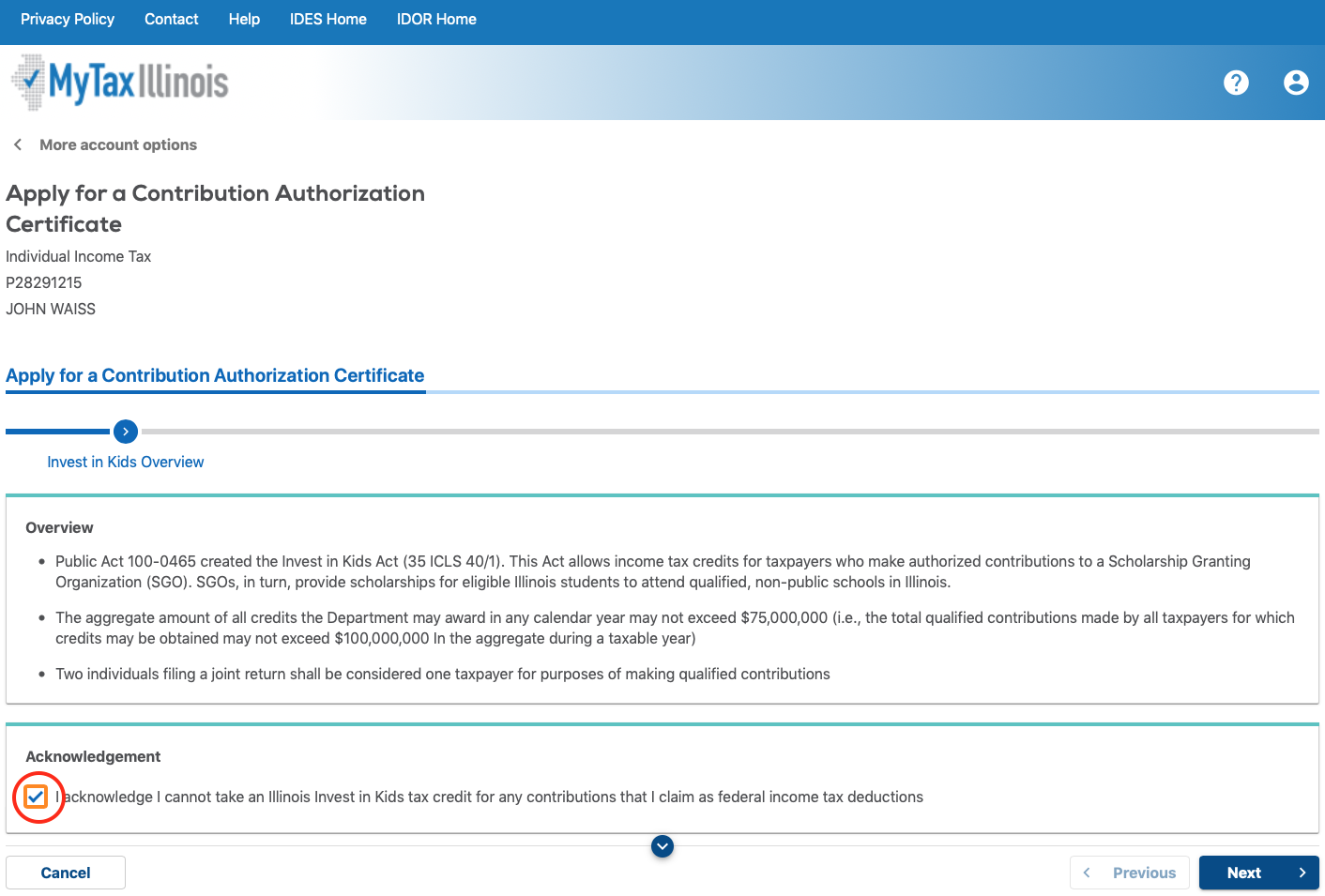

3c. Acknowledge that this contribution will NOT be eligible for a Federal Tax Deduction.

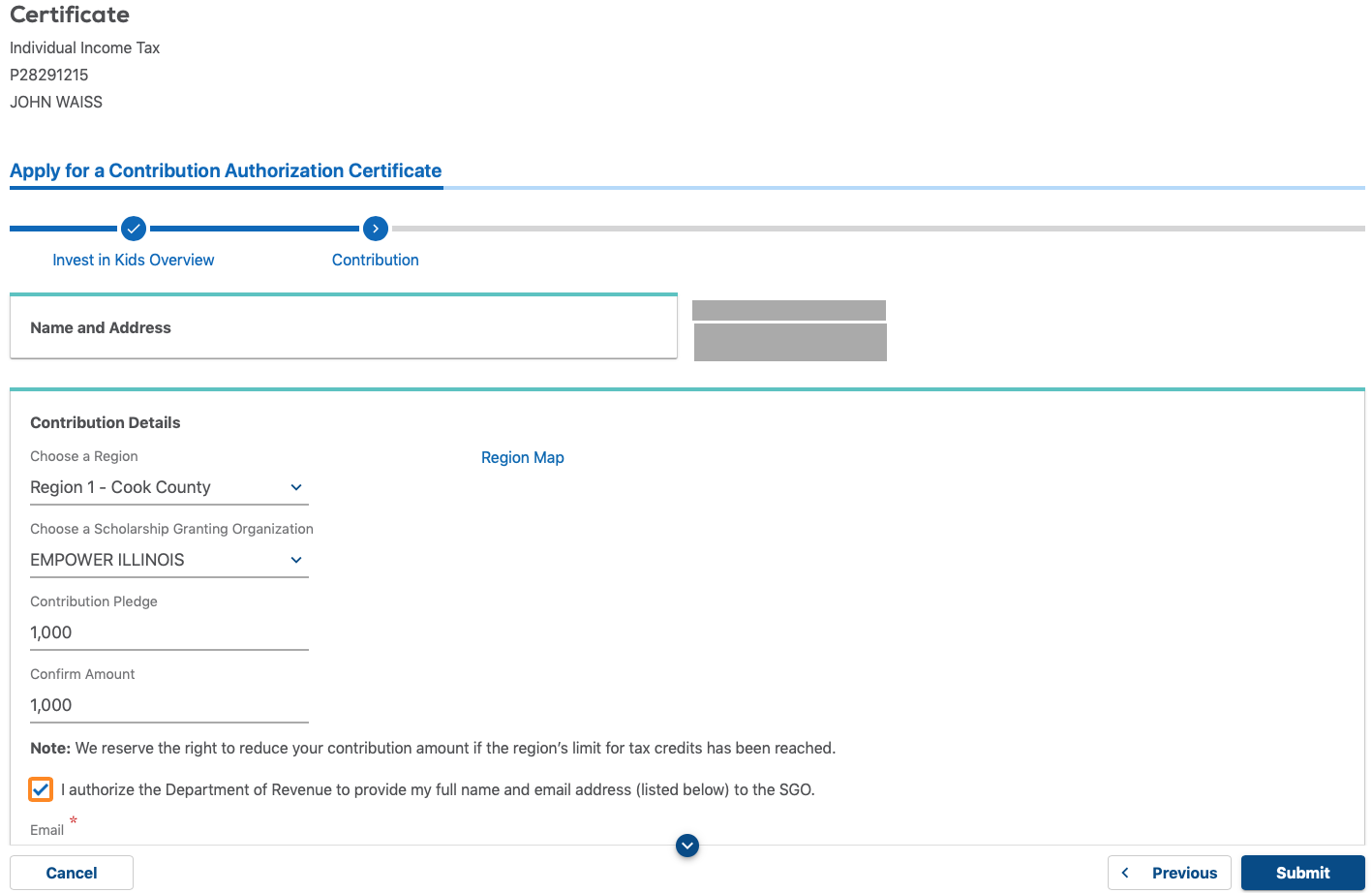

3d. Select a Region where your funds will be designated (not necessarily where you live): to benefit St. Mary of the Angels you must select Cook County and EmpowerIllinois or Big Shoulders as your SGO. Also enter the full amount of your scholarship pledge (the state will calculate your tax credit).

3e. Success!

Step 4: Wait for an Email from the Illinois Department of Revenue

It should come within 3 business days with instructions (mine came the same day).

4a. Log back into your MyTax.Illinois.gov account and click the CORRESPONDENCE tab

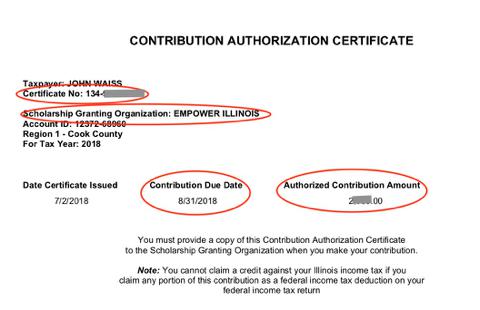

4b. View your Invest in Kids Contribution Authorization Certificate (CAC). This is a PDF letter you can download to your computer. It has needed information

A Certificate Number

The name of the Scholarship Granting Organization (such EmpowerIllinois or Big Shoulders)

Contribution Due Date

Step 5: Donate to Empower Illinois/Big Shoulders

5a: Go to EmpowerIllinois.org/donors/donate and choose how to donate (We’ll describe Donate Online)

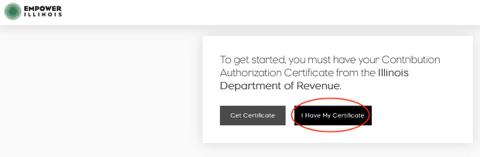

5b: Click Donate Online and click on “I Have My Certificate“

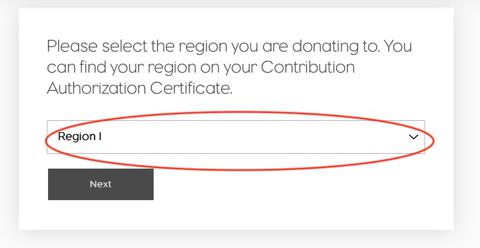

5c: Select “Region 1” and click “Next“

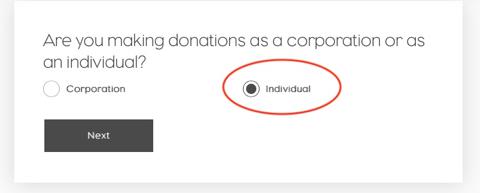

5d: Select “Individual” and click “Next“

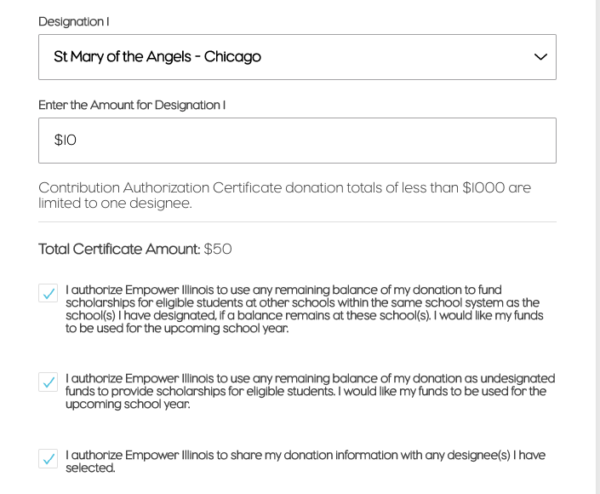

5e: Put in your “Certificate Number” and click “Donation Amount Total” (These numbers should correspond to your letter that you got back in Step 4b).

5f: Identify the Designation— “St. Mary of the Angels – Chicago” (although you can choose another)—and enter “Amount for Designation” (You can add additional Designations as seen below).

5f: Finally, you will put in your bank information and submit your donation.

Thank you very much for supporting Catholic Education and St. Mary of the Angels School!